High-spend travelers often search for premium rewards, strong lounge access, and simple redemptions. The U.S. Bank Altitude Reserve Visa Infinite Card historically fit that profile, though new applications have been paused since late 2024.

As an applicant, plan around the current closure and prepare for announced benefit changes scheduled for December 15, 2025.

Checking status updates first, then mapping alternatives, prevents wasted time and ensures a smoother path when application windows reopen.

Application Status in 2025

New applications remain unavailable as of September 2025. U.S. Bank closed public applications for the U.S. Bank Altitude Reserve Visa Infinite Card in November 2024, while existing cardholders continue using the product.

Program changes have been confirmed for December 15, 2025, including revised earning structures and redemption rules. Confirm status on U.S. Bank’s official pages or trusted outlets before planning any submission.

Closure Timeline and Current Availability

Public applications ended in November 2024, and no broad reopening has been announced as of today.

Existing accounts remain active, and U.S. Bank’s benefits and program-rules pages now display December 15, 2025 updates that affect earning rates, redemption values, and credits.

Treat the product as closed to new applicants until U.S. Bank restores an application link or issues targeted invitations.

How to Monitor Reopening or Targeted Offers

Check U.S. Bank’s Altitude Reserve benefits and program-rules pages for live term updates, then scan coverage from major points sites for reopening signals.

Watch for application links reappearing on the bank’s site, language referencing new-app eligibility, or branch-level invitations. Verify each report against the bank’s pages before acting, since third-party summaries can lag official postings.

Who Can Apply When Applications Return?

Historical patterns show stricter underwriting than mid-tier travel cards, including a preference for strong credit histories and stable income.

Earlier eras required an existing U.S. Bank relationship, though that rule was lifted before the 2024 closure; regardless, a deposit relationship may still support approval odds when applications resume.

Residency, age, and identity verification standards will apply, and bonus eligibility usually excludes recent recipients. Treat these points as preparation guidance rather than guarantees.

How to Apply: Step-By-Step

Short delays and rework vanish when documents, eligibility, and timing line up. Use the sequence below once applications reopen, or save it as a checklist if a targeted invite appears.

- Confirm current availability on U.S. Bank’s credit cards page and the Altitude Reserve benefits page, since application links may return without broad announcements.

- Set up or sign in to a U.S. Bank profile; consider opening a checking account in advance if aiming to strengthen your relationship footprint.

- Gather essentials: government ID, Social Security number or ITIN, annual income, housing costs, and employment details.

- Review key terms: annual fee, APR ranges, penalty language, and bonus eligibility clocks, especially if a prior Altitude-family bonus was earned.

- Submit the application online, in-app, or at a branch; keep contact details accurate to avoid verification delays.

- Complete any follow-up identity checks promptly, then activate the card upon approval.

- Enroll in loyalty benefits after activation, including Priority Pass and TSA PreCheck/Global Entry reimbursement tracking.

Rewards and Benefits: Current vs. Announced Changes

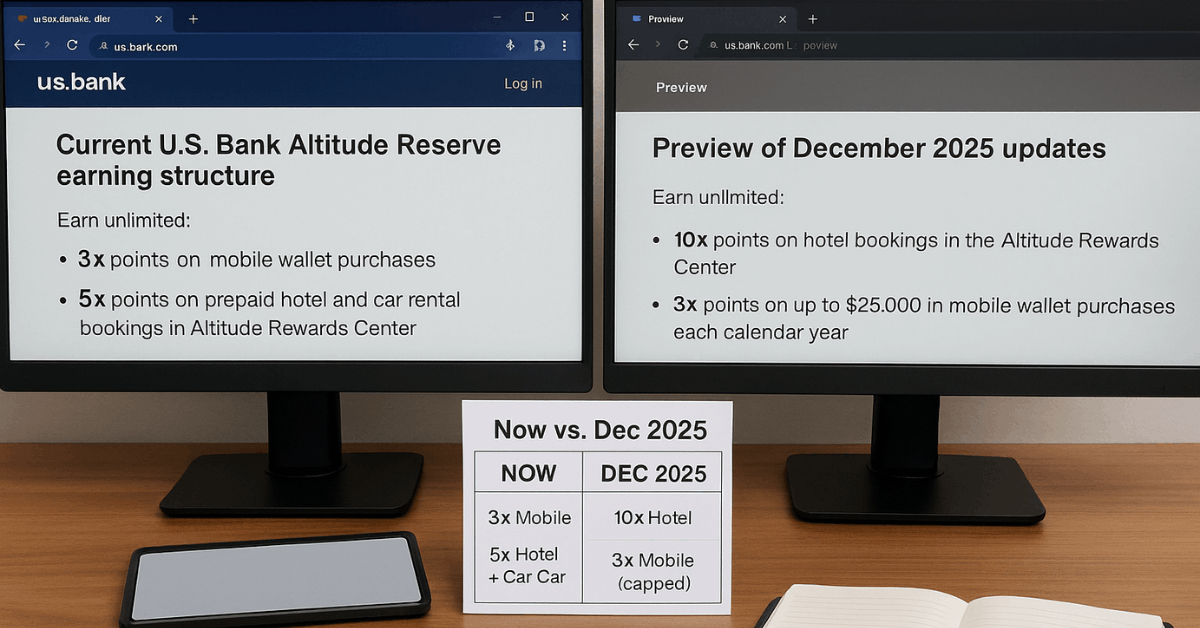

Planning purchases around the upcoming shift reduces surprises and preserves value. The table summarizes headline items for existing cardholders, noting changes U.S. Bank and major outlets have discussed for December 15, 2025.

| Feature | Now (until Dec 15, 2025) | Announced for Dec 15, 2025 |

| Annual fee | $400 | Unchanged in current communications. |

| Annual credit | $325 travel and dining credit with broad categories | Credit scope slated to narrow per bank notices. |

| Earning rates | 5x prepaid hotels/car rentals in Altitude Rewards Center; 3x eligible travel and mobile wallet; 1x other | Hotels/car rentals increase to 10x in portal; flights 5x in portal; 3x mobile wallet earnings capped. |

| Redemptions | 1.5¢ per point toward travel bookings via portal; lower values for cash/gift cards/merch | Lower point value for some portal redemptions; select gift cards discounted; charity redemptions matched; Amazon-related redemptions expand. |

| Lounge access | Priority Pass Select with 8 complimentary visits per year | Priority Pass access continues, details unchanged in current summaries. |

| Other travel perks | TSA PreCheck or Global Entry fee credit; no foreign transaction fees; Visa Infinite benefits | Perks expected to continue post-change. |

Strong Alternatives While Applications Remain Closed

Selecting a substitute now keeps travel plans moving while monitoring Altitude Reserve updates. Each option below delivers premium-tier value through different levers, so match benefits to actual usage rather than headline bonuses.

Chase Sapphire Reserve®

Flexible point transfers to airlines and hotels and a strong travel protections package suit frequent redeemers who prioritize transfer partners.

Capital One Venture X

Simple flat-rate earning, broad lounge network access, and family sharing features work well for multi-traveler households that prefer easy redemptions.

The Platinum Card® from American Express

Airport lounge depth, premium hotel benefits, and lifestyle credits favor travelers who leverage statement credits aggressively and value elite-style perks.

Common Application Questions

Short research cycles cut friction when windows reopen. Use the points below to frame expectations and avoid common pitfalls.

Does a U.S. Bank Relationship Help?

Earlier windows removed the “existing customer” rule, although many third-party experts still recommend holding a deposit account to support approval odds. Treat a checking relationship as optional but potentially helpful.

How Many Lounge Visits are Included?

Priority Pass Select tied to Altitude Reserve provides eight complimentary visits per membership year, then a per-visit fee applies. Enrollment is required after card activation.

What is the Real Value of Points?

Legacy redemptions deliver 1.5 cents each for travel booked through U.S. Bank’s portal, though December 2025 updates will alter some portal values and add niche redemption options.

Plan travel bookings ahead of the change if aiming to lock in a higher value.

Are Transfer Partners Available?

Point transfers to airline or hotel programs are not supported, which differentiates this product from several competing premium cards. That limitation will continue to matter for travelers who maximize partners.

Conclusion

Application doors for the U.S. Bank Altitude Reserve Visa Infinite Card remain closed, so preparation and timing matter more than speed.

Monitoring the official benefits page and reliable news sources will signal when submissions return and how revised terms affect value.

Travelers who want similar perks immediately should compare premium alternatives now, then revisit Altitude Reserve if availability and benefits align after the December 2025 updates.