Heavy PayPal shoppers look for simple rewards that stack reliably. The PayPal Cashback Mastercard targets those who need with uncapped cash back that peaks when checkout happens through PayPal.

If PayPal already sits at the center of daily purchases, this card can turn routine transactions into consistent returns without an annual fee. If PayPal is used only occasionally, a broader flat-rate card may fit better.

Key Terms and Rates

Expect variable APR tiers based on credit profile and no introductory APR period. If travel or foreign websites are common, factor in the international fee noted below.

| Feature | Details |

| Annual fee | $0 |

| Rewards | 3% cash back on PayPal purchases; 1.5% on other purchases |

| Intro offer / Intro APR | None |

| Regular APR | 19.24%, 30.99%, or 33.99% variable |

| Foreign transaction fee | 3% |

| Recommended credit | 690–850 (Good–Excellent) |

| Network / Issuer | Mastercard / Synchrony Bank |

| Instant use | Temporary line typically available inside PayPal after approval |

| Account requirement | PayPal account required to apply |

Most applicants want the essentials in one place before beginning any form. This quick snapshot covers fees, pricing, rewards logic, and access.

Rewards Structure Explained

Clear expectations prevent missed earnings and frustration. Cash back climbs to 3% only when PayPal checkout is used and the PayPal Cashback Mastercard is selected as the funding source.

All other transactions settle at 1.5%, which trails several competitors on non-PayPal swipes. If the goal involves maximizing returns across categories, pairing still helps, as outlined later.

PayPal Checkout at 3%

Retailers that support PayPal include names like Apple, Walmart, eBay, Etsy, Netflix, and travel brands such as Airbnb, American Airlines, and United Airlines.

Selecting the card inside PayPal unlocks 3% with no caps, which suits high-volume digital buyers and frequent travelers booking through PayPal.

Everywhere-Else Rate at 1.5%

Non-PayPal purchases earn 1.5% wherever Mastercard is accepted. That rate is serviceable for simplicity, although several cards deliver stronger value in set categories or across all purchases.

Redemption Rules and Timing

Cash back can be redeemed in any amount, which removes thresholds that delay access. Rewards typically become available about three days after an eligible transaction posts.

Depending on account type, redemptions can fund a PayPal Balance, pay the card, or move to a linked bank account or debit card.

Person-to-Person Transfers and Fees

Sending money through PayPal while funding the payment with the card earns 3% but triggers a PayPal fee of 2.9% plus $0.30 per transaction. After fees, the net gain is minimal or negative on many transfers, which makes routine P2P use a poor strategy for rewards.

Authorized Users and the 3% Rate

Authorized user cards generally cannot be added to a PayPal account, which blocks the 3% trigger at PayPal checkout. The primary card should be used for PayPal transactions when possible.

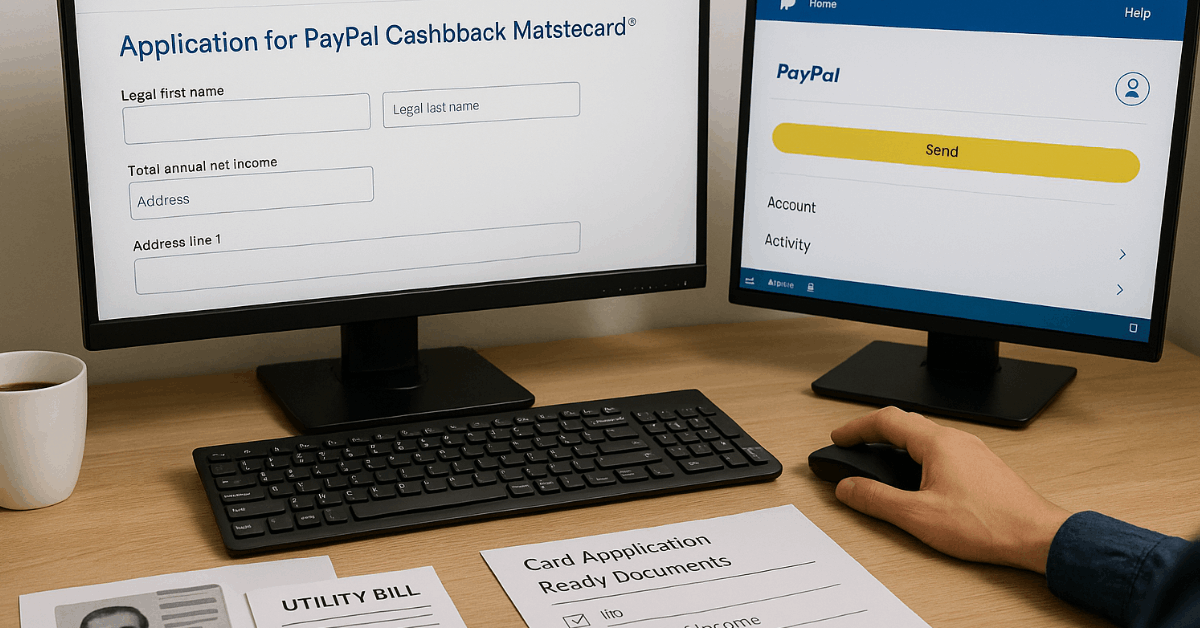

How to Apply Online

Application flow stays straightforward when the right items are ready. Eligibility depends on credit profile, identity verification, and having a PayPal account.

Instant decisions are common, and a temporary line usually appears inside PayPal after approval. Physical cards arrive later by mail.

- Confirm eligibility and create or sign in to a PayPal account, since a PayPal profile is required to start an application.

- Navigate to PayPal → Wallet or Offers → PayPal Cashback Mastercard, then select Apply to launch Synchrony’s secure application page.

- Enter full legal name, address, income, and security details, and consent to a credit check to allow a decision.

- Submit the form and review the result; if approved, a temporary credit line typically activates immediately for PayPal checkout.

- Activate the physical card after delivery, add it to digital wallets, choose autopay, and set the PayPal Cashback Mastercard as the PayPal funding source for 3% earnings.

Pros, Cons, and Fit

Many cardholders value a no annual fee structure paired with uncapped 3% at PayPal checkout, especially when online purchases already run through PayPal.

Everyday swipes outside PayPal only earn 1.5%, which feels modest compared to stronger flat-rate options or rich category bonuses available elsewhere.

Lack of a 0% intro APR and the 3% foreign transaction fee also narrow the appeal for balance carriers and international shoppers. Best results appear when PayPal dominates spending and checkout behavior can be adjusted to select the card within PayPal consistently.

Instant Access and Everyday Use

Approved applicants often receive immediate access to a temporary credit line inside PayPal, which enables same-day purchases without waiting for the physical card.

In-store or online merchants that accept Mastercard but not PayPal still work, although those transactions default to 1.5%.

Strong results depend on actively choosing the PayPal Cashback Mastercard as the funding method during PayPal checkout for each transaction.

Fees, Travel, and International Purchases

Foreign purchases incur a 3% foreign transaction fee, making dedicated travel cards without such fees more suitable for trips and cross-border e-commerce. Domestic use avoids that penalty and keeps rewards predictable.

Balance transfers and purchase financing receive no promotional APR, so carrying balances can become costly compared to cards designed for interest-free periods.

Alternatives to Consider

Smart pairings or substitutes can raise overall cash back depending on spend mix. Consider one higher-earning card for categories, then route everything else through the PayPal Cashback Mastercard at PayPal checkout.

Flat-Rate Cash Back

Citi Double Cash provides an effective 2% back on spending that is repaid, which beats 1.5% for non-PayPal purchases when uniform value matters.

Simple 2% Plus Intro APR

Wells Fargo Active Cash offers 2% on all purchases, a $0 annual fee, and introductory APR windows, which suit shoppers who want broad value and financing flexibility.

Rotating 5% Categories

Chase Freedom Flex and Discover it Cash Back cycle quarterly categories such as gas, restaurants, and grocery stores with activation requirements and caps, which can outperform 1.5% for targeted purchases.

Mixed Bonus Structure

Chase Freedom Unlimited combines multiple elevated categories plus 1.5% on other purchases, creating a middle ground for those who split spending across travel, dining, and pharmacies.

Who Should Choose It?

Frequent PayPal checkout users unlock the headline 3% cash back in the most effortless way, especially when large retailers or travel bookings already pass through PayPal.

Occasional PayPal users who want a single primary card may prefer a 2% flat-rate alternative or a category card that aligns with their largest expenses.

Those planning foreign travel should carry a no-foreign-transaction-fee card to avoid the 3% surcharge.

Conclusion

Heavy PayPal usage turns the PayPal Cashback Mastercard into a high-yield tool without an annual fee, provided checkout consistently routes through PayPal.

Broader spenders who rarely use PayPal will likely gain more from a 2% flat-rate card or a category strategy that pays better than 1.5% on everyday purchases.

If the application requirements are met and PayPal anchors routine buying, the online application can deliver immediate usability through a temporary line and predictable cash-back earnings thereafter.