You want an easy way to start investing with minimal effort. In this guide, you will learn how to invest spare change with micro-investment apps and turn small transfers into real portfolios.

We will define the tools, explain the benefits, and show what to check before choosing one. You will also see credible examples across major regions so you can pick a platform that fits your needs.

What Are Micro-Investment Apps and What Do They Do?

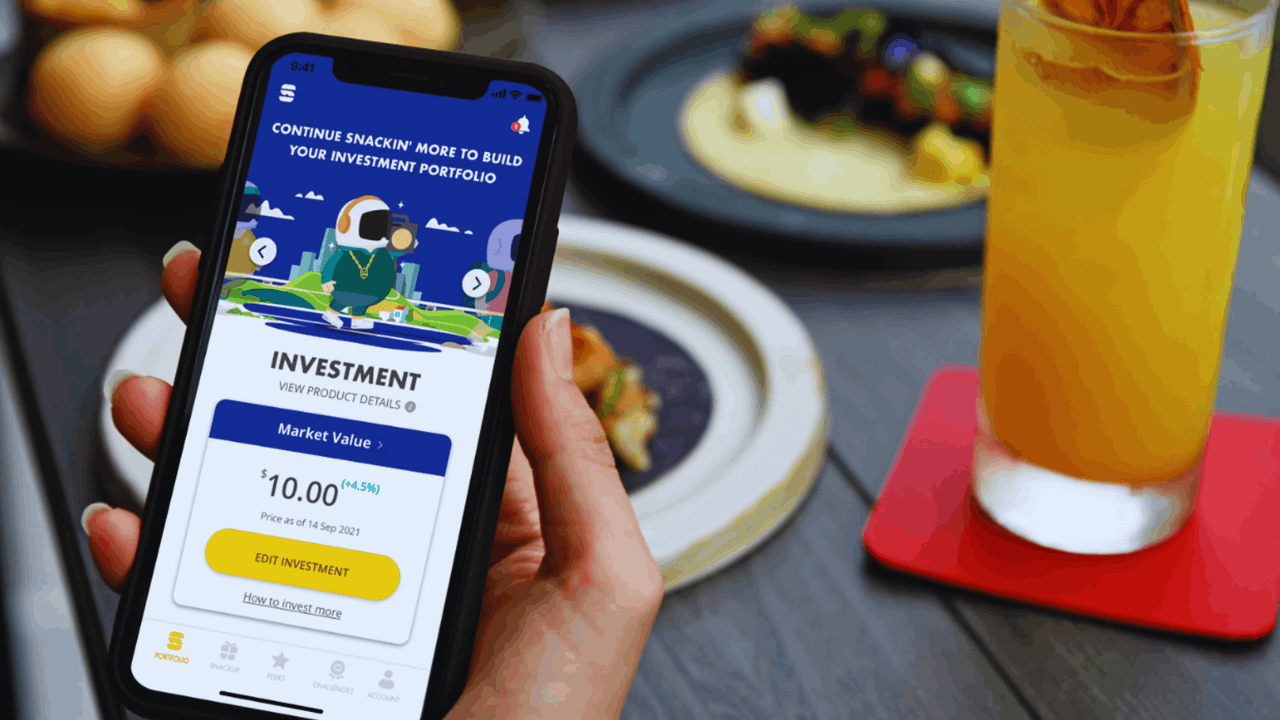

Micro-investment apps let you invest tiny amounts on a recurring basis. Many support fractional shares or ETFs so small deposits get diversified quickly.

Most offer round-ups that move the cents from purchases into your investing balance. The goal is simple automation that builds habits without extra work.

How Round-Ups and Automation Work

Round-ups track card transactions and collect the difference to the next whole number. The app transfers the tally once it reaches a small threshold.

You can add weekly auto-invest to boost momentum. These two features keep money flowing even on quiet spending days.

What You Can Actually Invest In

Choices vary by country and provider. Many apps offer managed ETF portfolios and sometimes individual stocks.

Some route round-ups to savings or crypto if you select that option. Always confirm where the spare change goes before you start.

Why You Should Start Investing Spare Change with Micro-Investment Apps

Small, steady transfers build the investing habit. Automation removes friction and decision fatigue.

You keep contributing even during busy weeks. Over time, consistent deposits can compound into meaningful balances.

Benefits That Help First-Time Investors Stick With It

Round-ups convert daily spending into investing with no extra steps. Recurring deposits add predictable growth on a schedule.

Starter portfolios reduce research and setup time. The process stays simple, which improves follow-through.

Real-World Caveats to Watch

Flat monthly fees can be heavy on tiny balances. Do the math on cost as a percentage of assets.

Check whether round-ups fund savings or investing by default. Review changes to features so your plan still works.

What to Consider When Choosing to Invest Spare Change with Micro-Investment Apps

Compare fees, account types, and country availability. Make sure the app supports the wrapper you want.

Tax-advantaged accounts can improve long-term outcomes. Confirm that automation matches your actual investment goal.

Fees, Wrappers, and Access

Some apps use flat subscriptions with bundled features. Others charge per trade with clear caps.

Pick the model that fits your deposit size and frequency. Favor transparency so costs never surprise you.

How Round-Ups Are Funded and Where They Go

Understand how the app links to your spending account. Verify the sweep timing and thresholds.

Confirm the destination is an investment product if that is your aim. Adjust settings as your goals evolve.

Top Micro-Investment Apps When Investing Spare Change

You can start with trusted brands that publish clear product pages and support documents.

The right choice depends on your country, desired account type, and preferred price model. Use this overview to shortlist providers and then confirm the latest terms in your region.

Each entry below focuses on how round-ups work and what makes the app useful for spare-change investing.

Acorns

Acorns pioneered round-ups in the United States by linking to your cards, rounding each purchase to the next dollar, and transferring the total to invest once the tally hits at least $5.

You can combine round-ups with recurring transfers for faster progress and choose a subscription tier that includes retirement accounts or family features. The pricing is simple and flat, which helps you predict costs even if you are not trading frequently.

For new investors who want a single app that automates both funding and portfolio management, Acorns remains a solid spare-change option.

Stash

Stash supports Stock Round-Ups that invest the spare change from purchases made with its Stock-Back debit card, and you can turn the feature on or off easily.

Beyond round-ups, Stash offers automated investing and guidance, which can help you pair small deposits with longer-term plans. The company clarifies that external-bank round-ups are not supported, so you will use the Stash ecosystem for the automation.

If you like the idea of rewards and round-ups living in the same place, this banking-plus-investing model is worth reviewing.

Moneybox

Moneybox began in the UK with round-ups and now offers investing through ISAs and other wrappers alongside savings options.

You connect a bank account or card, let the app track transactions, and round up your digital spare change to the nearest pound.

Clear disclaimers remind you that investments can fall as well as rise, which is important when you are new to markets. For UK residents who want both automation and tax-aware accounts, Moneybox provides a beginner-friendly path.

NuWealth (formerly Wombat)

NuWealth offers round-ups that link to your bank account and invest the difference on a schedule, alongside auto-invest features and thematic or index funds.

Updated guides confirm that round-ups are part of the platform’s standard toolkit, and the app explains how spare change is routed into an investing pot.

NuWealth positions itself for small amounts and lets you start with low minimums, which aligns well with a spare-change strategy. If you prefer a UK app that blends round-ups with low starting thresholds, NuWealth is a practical candidate.

Monzo Investments Round-Ups

Monzo introduced investment pots and added round-ups so card transactions can feed a chosen investment pot automatically.

Help resources and community notes outline how to enable round-ups in the Investments section and when money is swept into the pot.

This approach keeps your banking and investing in one app while preserving simple controls for turning the feature on or off. For customers who already use Monzo for spending, round-ups into an investment pot can simplify starting small.

Revolut

Revolut’s spare change feature rounds card transactions and lets you send the difference into savings pockets, to buy crypto, or to other destinations like rewards.

Revolut has also launched investing accounts in some regions, including tax-advantaged options where available, which you can pair with the automation.

Because routing options vary, confirm where your round-ups are going so they match your plan to invest rather than just save. If you already live in the Revolut ecosystem, this combination of spare-change automation and a separate investing account can be flexible.

Raiz Invest

In Australia and parts of Southeast Asia, Raiz lets you automatically round up purchases and invest the spare change into diversified portfolios.

Settings allow you to toggle round-ups, choose thresholds, and add recurring deposits to speed growth. Fees and portfolio choices are published clearly, which helps you estimate costs against a small balance.

Raiz is designed for background investing with very low minimums, making it a natural fit for building habits through tiny deposits.

Sharesies

Sharesies provides round-ups in Australia that funnel spare change into your wallet and then into your chosen investments when you reach a target.

The platform outlines its fee structure openly, including transaction fees and caps, which helps you estimate costs at small order sizes.

Because Sharesies spans AU, NZ, and US markets with fractional investing, it works well if you want both automation and broad market access. For spare-change investors who also want to hand-pick shares or funds, this combination is attractive.

Moka

In Canada, Moka connects to your accounts, rounds up purchases to the nearest dollar, and invests the difference into diversified portfolios. Reviews in recent years confirm that round-ups remain a core feature aimed at helping beginners automate contributions.

If you have seen references to card round-ups at other Canadian providers, note that some discontinued the feature, which makes Moka the more direct spare-change option today.

For Canadians who want a managed, hands-off approach funded by day-to-day spending, Moka is a strong fit.

Conclusion

You now know the tools, trade-offs, and leading options. Round-ups start the habit while scheduled deposits add structure.

Match fees, wrappers, and routing to your plan. Begin today with one trusted app and a clear system for how to invest spare change with micro-investment apps.