Getting control of existing card debt often starts with a single decision: move it to a longer interest-free window and pay it down methodically.

The Barclaycard Platinum Balance Transfer card offers a lengthy 0% period, a straightforward transfer fee, and helpful account extras that add modest value.

Terms vary by applicant, so expectations should balance headline figures with status-dependent outcomes. A clear application plan speeds approval and helps the transfer land within the promotional window.

How the Balance Transfer Offer Works

A long interest-free window on transferred balances creates room to reduce principal without interest adding back.

Transfers must be requested soon after account opening, and only from non-Barclaycard credit cards. New purchases have a short introductory period, so ongoing spending requires discipline while a transfer is being cleared.

Interest-Free Window

Barclaycard advertises up to 34 months at 0% on balance transfers, though some applicants receive 33 months or shorter terms based on credit profile and internal assessment.

Transfer Timing and Fee

Transfers attract a 3.45% one-off fee and must be completed within 60 days of account opening to qualify for 0%. A £1,000 transfer would add £34.50 to the balance.

Purchases and Cash

New purchases are 0% for three months, then revert to the standard variable purchase rate. Cash withdrawals incur a 2.99% fee (minimum £2.99) and start accruing interest immediately.

After the Promo

Once the 0% period ends, the account moves to a representative 24.9% APR (variable) on an assumed £1,200 limit, noting individual outcomes differ by status.

Key Rates and Fees

Card seekers compare headline numbers quickly, so the essentials appear side-by-side for faster scanning.

| Item | Core details |

| Balance transfer 0% period | Up to 34 months; actual term depends on status |

| Balance transfer fee | 3.45% per transfer |

| Transfer window | Complete transfers within 60 days of account opening |

| Purchases offer | 0% for 3 months, then variable rate applies |

| Representative APR | 24.9% APR (variable) based on a £1,200 limit |

Eligibility and Pre-Checks

Strong applications start with fit checks and a soft search to avoid unnecessary credit footprints.

Applicants must meet age, residency, and account requirements before submitting any details. A quick eligibility tool can signal likely acceptance without affecting credit score.

Basic Criteria

Applicants should be 18 or over, hold a bank account, and have a permanent UK address. A solid credit history with no recent serious defaults supports stronger outcomes.

Soft-Search First

Barclaycard’s free eligibility checker estimates acceptance odds without leaving a mark on a credit file. Submitting multiple full applications in a short period can lower scores, so a single targeted application is preferable.

Transfer Sources and Limits

Transfers must come from other providers, not another Barclaycard. The minimum transfer is £100, while the maximum depends on the approved credit limit and internal underwriting.

How to Apply Online

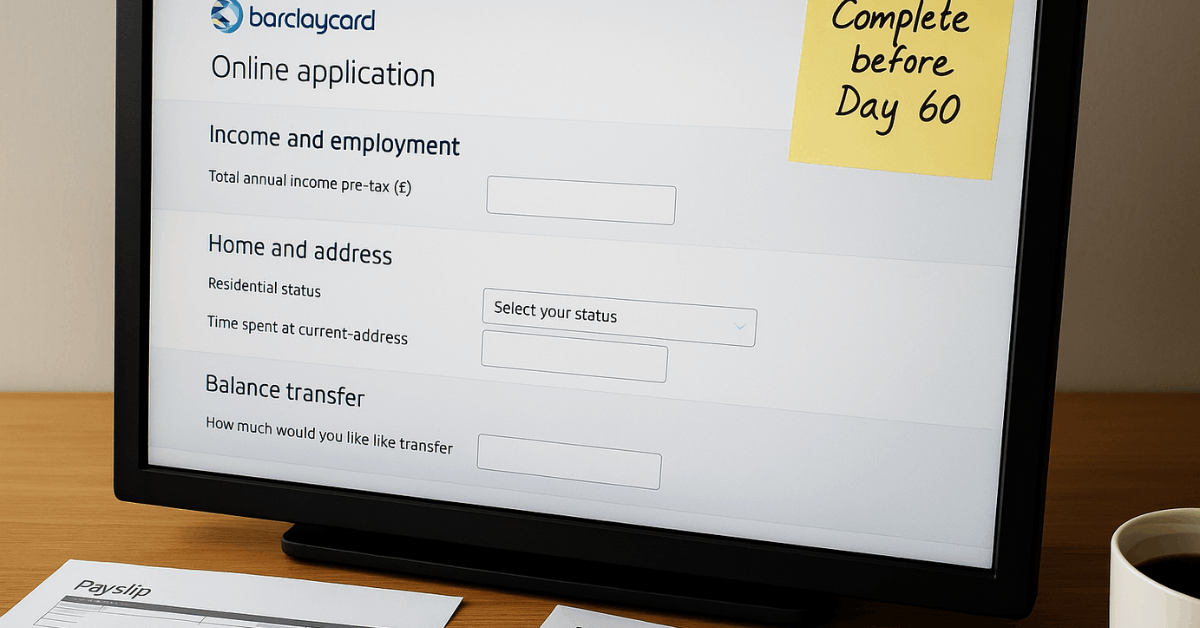

Applicants finish faster when details are ready and the transfer request is included at the start. A clean, one-pass application reduces back-and-forth and helps the 60-day timer work in your favor.

- Gather essentials: addresses for three years, income, employment, and details of the account(s) to be paid off.

- Run the soft-search eligibility check and proceed only if the results look reasonable for your situation.

- Complete the online form accurately, select Barclaycard Platinum balance transfer, and enter the transfer amount(s) and creditor details.

- Review disclosures, consent to checks, submit, and set up a Direct Debit for at least the minimum payment.

- Track approval and transfer progress in online servicing; request any remaining transfers before day 60.

Example Cost: One Transfer

Many applicants sanity-check the fee before committing, which helps set a clear repayment plan. A £1,000 transfer would add a £34.50 fee at 3.45%, creating a new balance of £1,034.50 at 0% for the allotted promo term.

Paying a fixed monthly amount that clears the full balance before the end date avoids any exposure to the standard rate afterward.

Rewards and Extras

A debt-clearance tool can still provide small everyday benefits without distracting from the payoff plan.

Barclaycard customers can activate Cashback Rewards in online servicing and earn up to 15% back with select retail and travel partners such as Virgin Atlantic Holidays, Caffè Nero, Holiday Inn, Morrisons, and LNER.

Barclaycard Entertainment also offers early access to selected events when paying with the card.

Purchase Protection

Larger transactions often raise risk questions, so statutory protections matter. Section 75 of the UK Consumer Credit Act makes the issuer jointly liable with the merchant for eligible purchases between £100 and £30,000.

Qualifying claims can include non-delivery, misrepresentation, or breach of contract where conditions are met.

Important Operational Notes

Clear boundaries keep the plan on track and reduce avoidable charges as the months progress. Foreign transactions attract a 2.99% non-sterling fee, making this card a weak choice for overseas spending during a transfer payoff phase.

Late payments cost £12 per incident, up to four times per year, and risk losing promotional terms; a Direct Debit at more than the minimum helps maintain momentum.

Balance transfers from another Barclaycard are not permitted, so choose external accounts only.

Who This Card Suits

Borrowers carrying interest-bearing balances who want a long 0% runway and a predictable fee will find a straightforward tool for accelerated payoff.

Applicants with strong credit and stable income tend to receive longer promotional periods, which materially improves the plan’s margin for error. Shoppers seeking no-FX-fee travel or frequent cash withdrawals should consider alternatives, since foreign and cash costs reduce value quickly.

Readers outside the UK should note UK residency requirements, making availability effectively UK-only despite broader interest in balance transfer strategies.

Conclusion

Choose Barclaycard Platinum for a long 0% window that lets you focus repayments on principal.

Use the soft-search checker, compare the fee to your transfer amount, and apply once the numbers align.

Complete transfers within 60 days, set a Direct Debit above the minimum, and keep purchases, cash, and foreign transactions off the card. Follow that plan and the promotional term should deliver meaningful interest savings before the rate reverts.