Flexible cash-back categories attract deal-hunters who plan their spending month by month.

The Bank of America Customized Cash Rewards card adds a rare twist: category control plus a first-year accelerator, then ongoing 3% in the category selected.

Careful planning helps offset a quarterly cap and a modest 1% base rate. Flat-rate alternatives suit heavy spenders who regularly blow past caps.

Snapshot: Rates, Fees, and Basics

Picking a cash-back card starts with the fundamentals, since rewards only matter when the core terms match your budget.

This card keeps costs predictable through a $0 annual fee and an introductory APR window for new purchases and early balance transfers.

Bonus cash for new accounts is straightforward, and the recommended credit profile skews toward good to excellent. Review the essentials below before comparing against flat-rate options.

| Feature | Details |

| Annual fee | $0 |

| Welcome bonus | $200 after $1,000 spend in 90 days |

| Rewards (year 1) | 6% in one chosen category; 2% at grocery stores & wholesale clubs; 1% other purchases; $2,500 quarterly cap combined on 6%/2% tiers, then 1% |

| Rewards (after year 1) | 3% in one chosen category; 2% at grocery stores & wholesale clubs; 1% other purchases; same $2,500 quarterly cap |

| Intro APR | 0% on purchases for 15 billing cycles; 0% on balance transfers made in first 60 days for 15 billing cycles |

| Balance transfer fee | 3% during first 60 days, then 4% |

| Regular APR | 18.24%–28.24% variable |

| Recommended credit | Good–Excellent (roughly 690–850) |

How the Rewards Work

Managing this program feels simple once the mechanics are set up properly. A monthly category selection controls the top earning rate, while groceries and wholesale clubs run on a separate 2% track. Hitting the combined quarterly cap drops those purchases to 1% until the next quarter resets. Careful timing of big transactions preserves the top rates longer.

- First-year accelerator: New accounts earn a promotional bump that lifts the chosen category to an effective 6% for twelve months. That boost is composed of the standard 3% plus an additional 3% layer for the first year.

- Ongoing structure: After the promotional year, the chosen category pays 3%, groceries and wholesale clubs pay 2%, and all other purchases earn 1%.

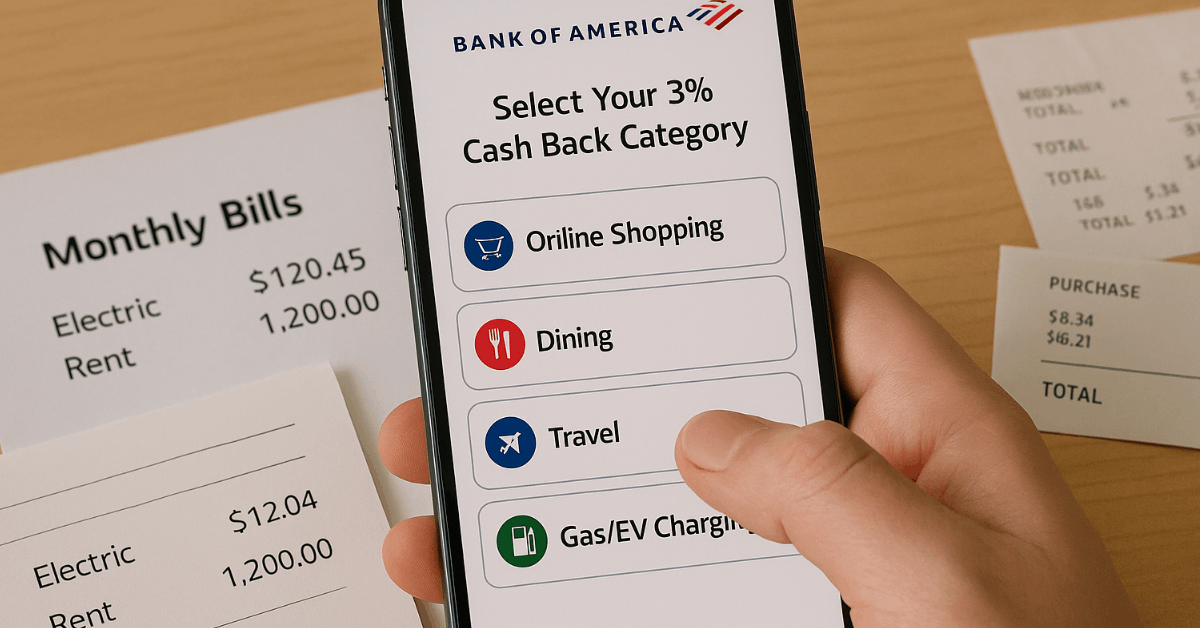

- Category choices and coverage: Options include Gas/EV charging, Online Shopping (including cable, streaming, internet, and phone plans), Dining, Travel, Drugstores, and Home Improvement & Furnishings. Definitions are broad, covering major e-commerce sites, restaurants and fast-casual spots, many travel providers, and a wide range of home services.

- Changing or defaulting: One change is allowed each month, which supports planned purchases such as travel bookings or home projects. No action defaults the category to gas, and the prior selection rolls forward until manually changed or the cap is reached.

Redemption Options and Rules

Cash back remains easy to use without complex hoops. One-time redemptions to a Bank of America account or as a statement credit have no minimum. Transfers to Merrill investment accounts or qualified 529 plans require at least $25. Automatic redemptions can be scheduled to a Bank of America account starting at $25, streamlining savings habits and avoiding idle rewards.

Who Benefits Most

Evaluating fit depends on spending patterns and tolerance for category management. A predictable routine in one or two categories generates solid value, especially when quarterly spending sits at or below the cap.

Bigger households that concentrate grocery and online purchases may exhaust the cap quickly and should weigh flat-rate alternatives.

- Best fit: Shoppers who plan major purchases month by month, drivers charging EVs or buying fuel regularly, frequent online buyers, and cardholders who keep banking or investment balances with Bank of America or Merrill.

- Think twice: High-spend households that routinely exceed $2,500 combined per quarter in bonus categories, or anyone who prefers a single card with simple 2%-plus cash back on everything.

Preferred Rewards Boost

Larger combined balances at Bank of America and Merrill unlock higher effective earning rates.

Tier bonuses apply to the underlying 3% category and 2% grocery/wholesale rates; the extra first-year 3% promotional portion is not boosted. Review the lift below to estimate realistic outcomes if relationship banking applies.

| Tier | Combined balances | Category effective rate | Grocery/Wholesale effective rate | All other |

| Gold | $20,000–$49,999 | 3.75% | 2.50% | 1.25% |

| Platinum | $50,000–$99,999 | 4.50% | 3.00% | 1.50% |

| Platinum Honors/Diamond | $100,000+ | 5.25% | 3.50% | 1.75% |

Pros and Cons

Managing expectations early avoids disappointment once the cap hits. A quick summary helps confirm alignment with priorities before applying.

Pros:

- Category control provides targeted earnings aligned to upcoming purchases.

- First-year accelerator can deliver outsized value on planned expenses.

- Broad category definitions capture common retailers and services.

- A $0 annual fee and flexible redemption options suit budget-conscious users.

- Relationship tiers significantly raise effective rates for loyal customers.

Cons:

- Quarterly cap limits value for heavier spenders across groceries and the chosen category.

- Base 1% rate trails flat-rate cards on uncapped everyday spending.

- Category selection adds management overhead that some prefer to avoid.

- Balance transfer fee applies even during the intro APR window.

- Best long-term rates depend on qualifying for relationship tiers.

Intro APR and Balance Transfers

Financing flexibility helps with large purchases or strategic debt moves. The card offers a 0% APR for 15 billing cycles on purchases and on balance transfers initiated within the first 60 days.

A 3% balance transfer fee applies during that 60-day window, increasing to 4% afterward. Planning transfers early secures the full promotional span; delaying erodes savings through higher fees and fewer zero-interest cycles.

Smart Ways to Maximize Value

Careful pacing matters more here than on flat-rate cards. Big transactions should be scheduled in months where the relevant category is active, and before the quarterly cap kicks in.

Grocery-heavy households can split spending across partners or pair this card with a flat-rate option to maintain yield after the cap. Online Shopping often covers streaming and telecom bills, making recurring charges a reliable anchor during lighter months.

Alternatives to Consider

Wells Fargo Active Cash, a simple 2% cash-back structure without caps, suits high monthly spend or those who dislike category management. Citi Double Cash, an effective 2% back (1% at purchase, 1% at payoff), appeals to disciplined payers who want broad coverage and a long balance-transfer intro window.

Discover it Cash Back offers quarterly 5% rotating categories, up to a set limit per quarter (activation required), making it ideal for buyers who enjoy optimizing their calendar and tracking seasonal categories.

U.S. Bank Cash+ Visa Signature offers two 5% categories (with a combined monthly cap) plus one 2% everyday category, rewarding spenders who can align purchases to narrower definitions.

Eligibility and Typical Applicant Profile

Approval odds improve with stronger credit and clean utilization. Data points from third-party aggregators suggest that average matched credit scores are around the high 600s to low 700s, with many approvals falling within the good-credit range.

Average starting limits typically range from the mid-four figures to the low-five figures, reflecting income, debt levels, and credit history. Individual outcomes vary by profile, banking relationship, and recent inquiries.

Conclusion

Category control and a meaningful first-year boost make Bank of America Customized Cash Rewards compelling for planners who keep spending under the quarterly cap.

Relationship banking elevates the value further, lifting everyday rates well above typical no-fee cards.

Heavy spenders or set-and-forget users will likely earn more with a flat-rate 2% card, while optimizers can extract strong returns by timing big purchases and rotating the chosen category deliberately.